Press Contact:

Nicole Hager, 202-224-4515

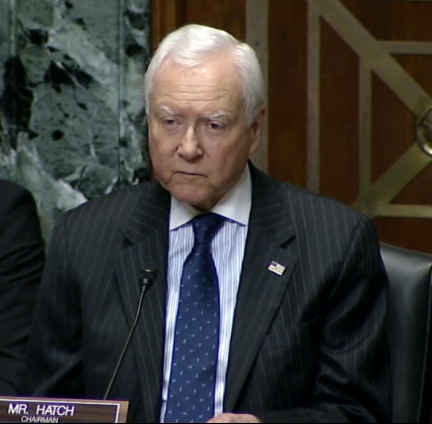

Hatch Opening Statement at Tax Court Nomination Hearing

Watch Chairman Hatch's Opening Statement Here

WASHINGTON – Senate Finance Committee Chairman Sen. Orrin Hatch (R-Utah) today delivered the following opening statement at a hearing to consider the nomination of Courtney Dunbar Jones to be a judge on the United States Tax Court. This was Chairman Hatch’s final hearing leading the Finance Committee. Hatch has been chairman of the committee since 2015 and served as ranking member for four years before that. Hatch has been a member of the committee since June of 1991:

Today we will consider the nomination of Ms. Courtney Dunbar Jones to be a judge for the United States Tax Court. Before I speak to the position Ms. Jones has been nominated to, and her qualifications, I would like to note that this will likely be my last hearing as chairman of the Finance Committee.

I have served on this committee since 1991, and while I’ve had more than a few arguments sitting in this chair, I’ve also made a lot of friends here, and negotiated the passage of a lot of laws. It has been one of the great honors of my life to serve on this committee. I will miss it, as well as my friends here on both sides of the aisle, but I know I will be leaving the Committee in capable hands.

Now on to the matter at hand. The U.S. Tax Court plays an important role in our tax system as it is the only avenue for taxpayers to challenge what may be an improperly assessed tax liability before being forced to send in payment or receive a refund. Judges on the Tax Court are some of the very few government officials who deal face-to-face with individual taxpayers on issues relating to their taxes. Therefore, it is important that we keep the court staffed with qualified judges to ensure accountability to taxpayers and timely access.

Ms. Jones, if confirmed, would serve as one of these important government officials. Currently, Ms. Jones serves as a Senior Attorney in the Office of the Chief Counsel at the Internal Revenue Service, focusing on advising the IRS and Department of Justice on litigation in the federal judiciary related to tax-exempt organizations.

She completed her undergraduate degree at Hampton University, where she currently serves as a trustee, and is a 2004 graduate of Harvard Law School. With over a decade’s experience practicing tax law in both the public and private sectors, I have no doubt she is duly qualified for the position.

Ms. Jones is joined this morning by many friends and family including the Honorable Vanessa Gilmore, U.S. District Court Judge for the Southern District of Texas. Judge Gilmore is also a graduate of Ms. Jones’ alma mater, Hampton University, and has mentored her over the last 20 years. Also here in support are several members of her sorority, Delta Sigma Theta, a service sorority which focuses on lifelong scholarship and service.

I want to also recognize Colonel James George and his service of 27 years to the U.S. Army. Like Ms. Jones, he is a graduate of Hampton University and a fellow trustee. We are also joined by several members of the U.S. Tax Court. Chief Judge Maurice Foley, Judge Tamara Ashford. Judge Elizabeth Copeland, Judge David Gustafson, Judge Kathleen Kerrigan, Judge L. Paige Marvel, Judge Elizabeth Crewson Paris, Special Trial Judge Diana Leyden, and Legislative Counsel Anita Horn Rizek, welcome.

Ms. Jones, I want to thank you for being here today, and also thank you for your willingness to serve.

###

Next Article Previous Article