Press Contact:

202-224-4515, Katie Niederee and Julia Lawless

Hatch: This is the Longest CHIP Extension Since Its Creation

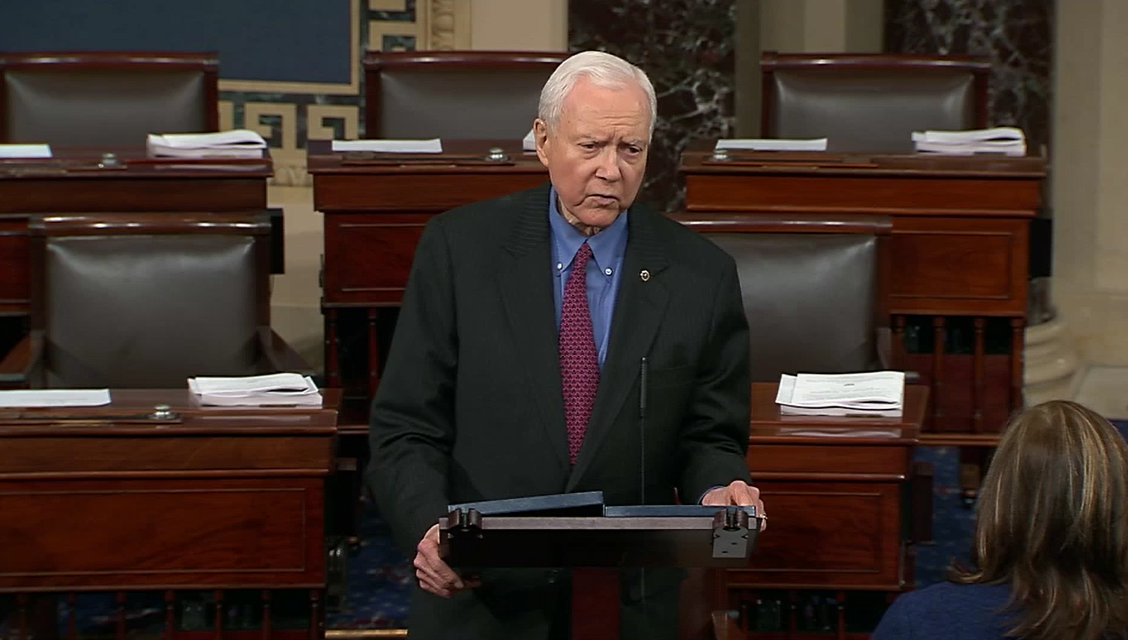

Finance Committee Chairman Highlights CHIP Extension, Obamacare Tax Delays on Senate Floor

CLICK HERE to watch Hatch Speak on CHIP Extension, Obamacare Tax Delays.

WASHINGTON – Senate Finance Committee Chairman Orrin Hatch (R-Utah) today spoke on the Senate floor regarding the critical healthcare provisions he helped secure in the proposed government funding bill. Specifically, Hatch emphasized the six-year extension of the Children’s Health Insurance Program (CHIP), nearly identical to the agreement he struck with Finance Committee Ranking Member Ron Wyden (D-Ore.), which overwhelmingly passed the Finance Committee last fall. Additionally, Hatch highlighted delays of Obamacare’s medical device tax, Cadillac tax and Health Insurance Tax (HIT)– burdensome taxes that he has worked diligently to repeal since Obamacare’s inception.

On CHIP:

“I’ll remind my colleagues that, this past September, the Finance Committee’s Ranking Member, Senator Wyden, and I introduced a long-term, bipartisan CHIP extension bill that was overwhelmingly reported out of the committee… The House’s bill is identical to the legislation Senator Wyden and I introduced last fall, except that the funding continues for one more year. As I noted, it extends CHIP for six years. We’ve never gotten such a long extension since the creation of the program over 20 years ago.”

On Obamacare taxes:

“[T]he House legislation addresses some other long-term priorities of mine: The taxes imposed by the so-called Affordable Care Act… Under the bill, the job-killing medical device tax will be delayed for another two years…Eliminating this tax has been an important cause to me since the day Obamacare was signed into law…The House package also extends the delayed impact of the so-called Cadillac Tax, which was another one of Obamacare’s ill-advised shots aimed at the middle class… Finally, the bill would pull back the Health Insurance Tax, another reckless tax provision, in 2019. This tax targets small businesses and middle class consumers.”

Hatch’s full remarks can be found below:

Mr. President, as we move closer to the expiration date for federal government funding at the end of this week, there is no shortage of rancor in the air. Pundits and partisans have, for weeks now, been arguing incessantly about a wide range of issues, all of which, in one way or another, have been tied to this fast-approaching deadline.

Don’t get me wrong, there are legitimate issues at play this week. These debates, to the extent they are focused on solutions, are meaningful. And, I’m optimistic that we can find solutions. Today, I’d like to talk about some of the more positive developments we’ve seen recently with regard to the health care aspects of the current debate.

As you know, last night, leaders in the House unveiled a legislative package that would keep the government funded as well as address some bipartisan health care priorities, including a number of issues that I personally have been working on for some time. I’m hoping that the House will pass this legislation in short order and that the Senate will quickly follow suit.

Let’s talk about some of the specifics in the package.

First, the House bill would extend funding for the Children’s Health Insurance Program for six years, which is the longest extension since the creation of the program.

As I’m sure you know, Mr. President, I am the original author of the CHIP program. Twenty years ago, Senator Ted Kennedy joined with me to draft the original CHIP legislation and to move it through Congress on a bipartisan basis. I have maintained my commitment to this program for the past two decades, even during times when others sought to change it dramatically from its original purpose.

During this Congress, as the Chairman of the Finance Committee, I have been working with colleagues on a long-term reauthorization of CHIP, despite some contrary claims that I, and the Republican leadership, had somehow neglected or forgotten about the CHIP program and had no intention of reauthorizing it. It’s no secret that I’ve taken some flak in some corners here in the Senate, from colleagues looking to get some political mileage out of an issue I’ve worked so hard to keep bipartisan.

But, I’ll remind my colleagues that, this past September, the Finance Committee’s Ranking Member, Senator Wyden, and I introduced a long-term, bipartisan CHIP extension bill that was overwhelmingly reported out of the committee. A number of my colleagues, including some who were on the committee and voted in favor of that bill, seem to have forgotten that this legislation had been drafted and reported. We’ve endured a number of speeches and television appearances from colleagues accusing Republicans of abandoning children in need, even though our friends on the other side were entirely aware that the effort to reauthorize the program had been continually moving forward.

The House’s bill is identical to the legislation Senator Wyden and I introduced last fall, except that the funding continues for one more year.

As I noted, it extends CHIP for six years. We’ve never gotten such a long extension since the creation of the program over 20 years ago.

I hope my colleagues in the Senate, particularly those who have been so outspoken and riotous in their condemnations of Republicans regarding CHIP, will support this legislation. It would be odd to see them vote it down after all the acrimony we’ve endured the past few months.

In addition to an historic CHIP reauthorization, the House legislation addresses some other long-term priorities of mine: The taxes imposed by the so-called Affordable Care Act.

Under the bill, the job-killing medical device tax will be delayed for another two years. This foolhardy tax, which has been criticized and condemned by members of both parties, came back into effect at the start of this year.

Eliminating this tax has been an important cause to me since the day Obamacare was signed into law. Utah is home to some of our nation’s most innovative medical device companies. And, the U.S. has led the world in developing life-saving and live-improving medical technology, an advantage that was threatened by this poorly crafted and irresponsible tax.

I’d like to see the medical device tax repealed entirely. I’ve introduced a number of bills to that effect over the years. But, until we can get that done, it is important that we keep shielding American consumers, patients, families, and job creators from the impact of this tax. The House bill would prevent the medical device from hitting any device innovators – and their customers – until 2020, at the earliest.

The House package also extends the delayed impact of the so-called Cadillac Tax, which was another one of Obamacare’s ill-advised shots aimed at the middle class. Again, members from both parties have expressed concern and opposed this tax. Previous delays have received broad, bipartisan support. The House bill would put off the impact of the Cadillac Tax through 2021, and I am hopeful this delay receives bipartisan support in the House and Senate.

Finally, the bill would pull back the Health Insurance Tax, another reckless tax provision, in 2019. This tax targets small businesses and middle class consumers. There’s not even a set rate for this tax, Mr. President, there is a revenue target and the rate moves around from year to year in order to raise a specified amount. The results are increased costs passed along to insurance beneficiaries in the form of higher premiums and increased burdens on small businesses.

The House bill will give additional relief from this tax starting in January of next year so that insurers can lower premiums before the 2019 filing period.

So, as you can see, Mr. President, in addition to keeping the government open, the legislative package unveiled last night in the House would address some key, bipartisan health care priorities. I urge my colleagues on both sides of the aisle to support this approach. Given their recent statements on some of these issues and their past votes, I think many Democrats would have a hard time explaining to their constituents why they opposed these measures.

While there are still a number of health care priorities that must be addressed as quickly as possible, including Medicare extenders, I am very pleased to see the House moving forward with a long-term extension of CHIP and relief to some of the most burdensome ACA taxes. I’ve been working with my colleagues in both parties and in both chambers to bring these efforts to fruition. Once again, I hope all of my colleagues will join me in supporting this legislation once we receive it from the House.

###

Next Article Previous Article