Press Contact:

Katie Niederee and Julia Lawless, 202-224-4515

Hatch: Treasury Policy Change Will Protect Taxpayers

Utah Senator Says Common-Sense Reform Is No Reason to Oppose Qualified, Competent Nominee

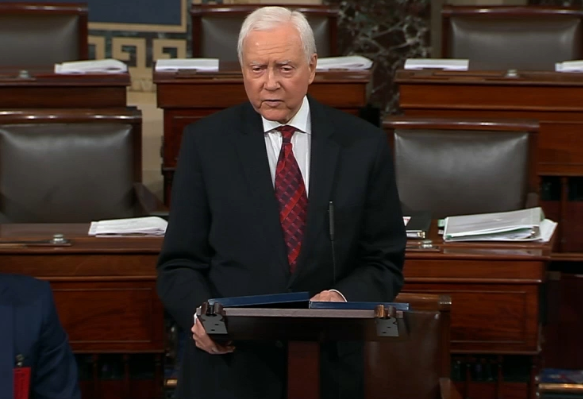

Hatch discusses Treasury policy change to protect taxpayers and save resources, on Senate floor.

WASHINGTON – Senate Finance Committee Chairman Orrin Hatch (R-Utah) today took to the Senate floor to praise the Treasury Department’s decision to no longer require many tax-exempt groups to disclose the names and addresses of taxpayers who made substantial donations.

“The IRS has been forcing the collection of information it doesn’t need that can easily get leaked out and cause problems for the IRS, the organizations, the individual donors, and the American people generally,” Hatch said on the Senate floor. “In the end, this process has turned into a disproportionate amount of work and expense of taxpayer dollars with few benefits in return…the Trump administration listened to the agency’s concerns, contemplated the facts, and did what any sane government should do. It enacted changes that would help the IRS focus on what’s most important, instead of needlessly risking resources and private taxpayer information. And, the administration was wise enough to accept the idea that arose out of the Obama administration.”

Hatch also emphasized that this policy change is no reason to oppose the nomination of Charles Rettig to be IRS Commissioner:

“My friends on the other side, including Ranking Member Wyden, announced a newfound opposition to Mr. Rettig based not on anything he has done, nor on anything he hasn’t done,” Hatch said. “Instead, they’ve decided to broadly oppose Mr. Rettig because of a recent regulatory change at the Treasury Department…None of the Democrats concerns or opposition have anything to do with Mr. Rettig, and as his nomination moves forward I’ll continue to talk about his incredible qualifications to be IRS Commissioner as we move through his nomination process.”

Last week, the Finance Committee advanced the Rettig nomination out of committee.

Mr. President, last week the Finance Committee met to consider the nomination of Charles Rettig to be the Commissioner of the Internal Revenue Service. He is a highly qualified man who I had long believed had near universal support from the members of the committee.

I suppose it shouldn’t be surprising, but my colleagues on the other side of the aisle were finally able to find an excuse for why they couldn’t support this well qualified practitioner. My friends on the other side, including Ranking Member Wyden, announced a newfound opposition to Mr. Rettig based not on anything he has done, nor on anything he hasn’t done. Instead, they’ve decided to broadly oppose Mr. Rettig because of a recent regulatory change at the Treasury Department.

Now, some of you may be scratching your heads wondering how, if he hasn’t been confirmed yet, does he have anything do with this new regulatory change? I know. It’s puzzling. And when you get into the weeds, it becomes clear that my friends have just been looking for an excuse to keep this well-qualified practitioner from heading up the IRS when our country needs him most.

Democrats also raised extraneous news report of a Russian person allegedly infiltrating the NRA and potentially infusing domestic organizations with so-called “dark money.” Interestingly, though, they seem not to be at all interested in subsequent revelations that the very same person had meetings with at least one Federal Reserve official and at least one high level official in the Treasury Department during the Obama Administration. Evidently, for Democrats, when it comes to activities that are quite concerning, the concerns vanish if the activities involved officials in a Democrat administration.

The point is: None of the Democrats concerns or opposition have anything to do with Mr. Rettig, and as his nomination moves forward I’ll continue to talk about his incredible qualifications to be IRS Commissioner as we move through his nomination process. But today, I want to take a minute to address the Treasury Department’s actions.

By way of background, the Treasury Department changed an outdated Nixon administration rule that required certain tax-exempt organizations to report the names and addresses of taxpayers who made substantial donations. This requirement didn’t arise out of a current statute, it isn’t useful for tax administration, and it unnecessarily puts taxpayer information at risk. Cognizant of these issues, the Treasury Department changed that rule.

Not such a dramatic change. But to hear my Democratic colleagues react, you’d think the Department repealed the Bill of Rights or sold our Democracy down the river. That’s why I think it is critical to note that, despite the rule change, IRS still has access to this information should the agency need it.

Of course, you’d never know that when listening to my friends on the other side of the aisle as they cherry-pick their facts, but, for the rest of us, I think we should all take a step back, take a deep breath, and consider what has actually taken place.

Back in 1969, Congress amended the Internal Revenue Code requiring 501(c)(3) charities file an annual return that includes the names and addresses of substantial contributors. This rule makes perfect sense. After all, taxpayers receive a tax deduction for these donations, so the IRS needs to be able to verify that individual taxpayers actually donated what they said they did. It’s a great tax fraud prevention tool.

However, this taxpayer information is extremely sensitive and must be safeguarded from a data breach or other improper revelation. That’s why Congress chose to prohibit public disclosure of this information.

Then, two years later, in 1971, President Nixon’s Treasury Department issued further regulations extending this requirement to contributions made to 501(c)(4), (5), and (6) organizations. For those who don’t stay up late at night reading the tax code for fun, these organizations include: social welfare, labor, and agricultural organizations, as well as chambers of commerce.

This regulation went beyond what is required by the statute, and, thus, beyond what Congress wrote, when requiring non-charity tax exempt organizations to disclose personally identifiable taxpayer information—namely the names, addresses, and donations for anyone who contributed $5,000 or more to that particular social welfare organization.

Remember, these contributions are not tax deductible, so the IRS has less need for this information. And, it’s key to remember that the law generally requires the returns of tax exempt organizations be made publicly available. Taken together, this means that the IRS has been forcing the collection of information it doesn’t need that can easily get leaked out and cause problems for the IRS, the organizations, the individual donors, and the American people generally. As such, and in order to avoid these important privacy issues, the IRS has had to spend precious time and resources redacting this information.

Again, information that the agency did not need to collect in the first place and that does no good in helping thwart tax evasion or fraud. In the end, this process has turned into a disproportionate amount of work and expense of taxpayer dollars with few benefits in return.

All of that, while not the most exciting topic for a dinner conversation, is what brings us to today. And all of that is why the IRS has been looking at changing this requirement during and since the Obama administration. The IRS has broadly noted three reasons for this change:

First, as I mentioned, the IRS doesn’t need the personally identifiable information of these donors to carry out its mission. While this information was helpful to administering the gift tax, in 2015, Congress changed the law on the application of the gift tax, so it’s no longer relevant here. And that change was broadly bipartisan.

Second, requiring the reporting of donor information consumes a lot of time and money. Both at the IRS as well as at tax-exempt organizations. This directly conflicts with our goal of making the IRS more efficient and helpful for the American taxpayers.

Third, Schedule B returns with personally identifiable information of donors have a tendency to leak. This poses a risk to taxpayer privacy. It creates a liability for the IRS. And it erodes the trust of the American people in our tax collection agency. And this risk is very real. Since 2010, the IRS is aware of at least 14 breaches that resulted in the unauthorized disclosure of this type of information. Mind you, those are cases that we know of.

That’s why, earlier this month, the Trump administration listened to the agency’s concerns, contemplated the facts, and did what any sane government should do.

It enacted changes that would help the IRS focus on what’s most important, instead of needlessly risking resources and private taxpayer information. And, the administration was wise enough to accept the idea that arose out of the Obama administration. That’s just good government, Mr. President.

And yet, if you listened to my Democratic colleagues these past few days, you would think that Democracy as we know it has been destroyed. You might even think that the IRS and the Trump administration have been bought and paid for by this nebulous so-called dark money.

The truth is, these attacks are just a partisan stunt. Because, even if you believed this intricate weaving of a conspiracy theory, it ignores the plain fact that the IRS actually still has access to donor information if it wants it. Nothing is being deleted.

Instead, leaks of sensitive taxpayer information will be less common. The IRS is less likely to become a political beach ball smacked back and forth across the aisle. And this administration had the common sense to take up a Democrat president’s work to eliminate pointless busywork for the IRS and tax-exempt organizations.

Honestly, if this isn’t good government, I don’t know what is. So, Mr. President, let’s ignore this pointless obstruction and get back to work. After all there’s a lot to do.

###

Next Article Previous Article