One Big Beautiful Bill: New Tax Relief Overwhelmingly Benefits Working Class

JCT: Those making less than $50,000 receive largest proportional benefit

Washington, D.C.--Through policies like a standard deduction boost, tax benefits for child care affordability, and delivering on the President’s agenda on no taxes on tips, no taxes on overtime, and tax relief for seniors, Senate Republicans’ legislation provides significant relief to low- and middle-income Americans.

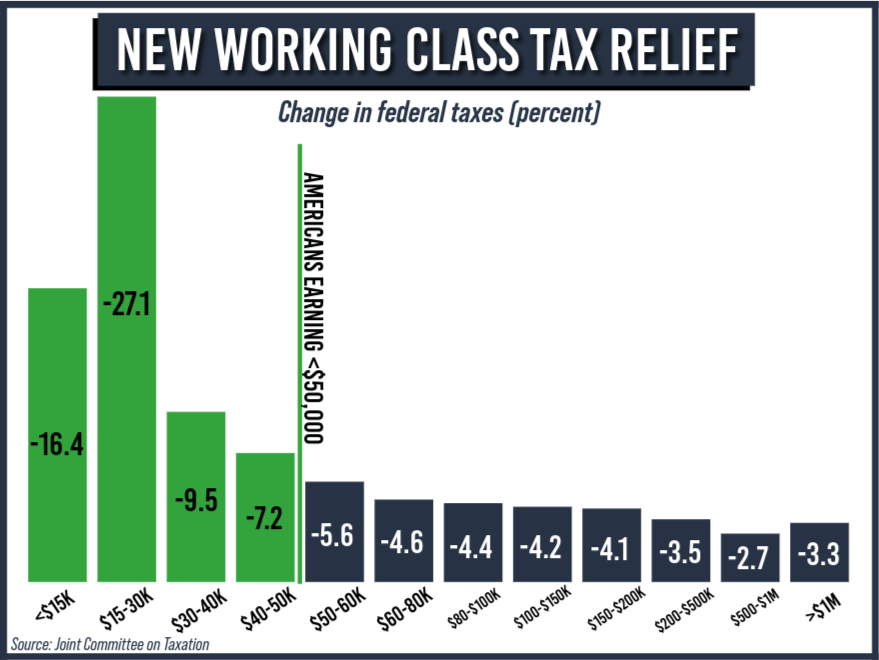

According to a distributional analysis from the nonpartisan Joint Committee on Taxation—which previously estimated the tax bill provides more than $600 billion in new tax relief to middle-class households—the largest proportional tax benefits go to workers and families making less than $50,000.

“Despite false narratives about ‘tax cuts for billionaires and corporations,’ the reality is this legislation not only prevents massive across-the-board tax hikes, but also provides new tax relief that overwhelmingly benefits low- and middle-class families and workers,” said Finance Committee Chairman Mike Crapo (R-Idaho).

According to JCT’s analysis, for the following income categories, the new tax relief would provide:

- Less than $15,000 – 16.4% cut

- $15,000-$30,000 – 27.1% cut

- $30,000-$40,000 – 9.5% cut

- $40,000-$50,000 – 7.2% cut

READ: Tax Wins for Hardworking Americans and Main Street

READ: One Big Beautiful Bill Delivers Historic Tax Relief, Achieves Record Savings

Next Article Previous Article