Press Contact:

202-224-4515, Katie Niederee and Julia Lawless

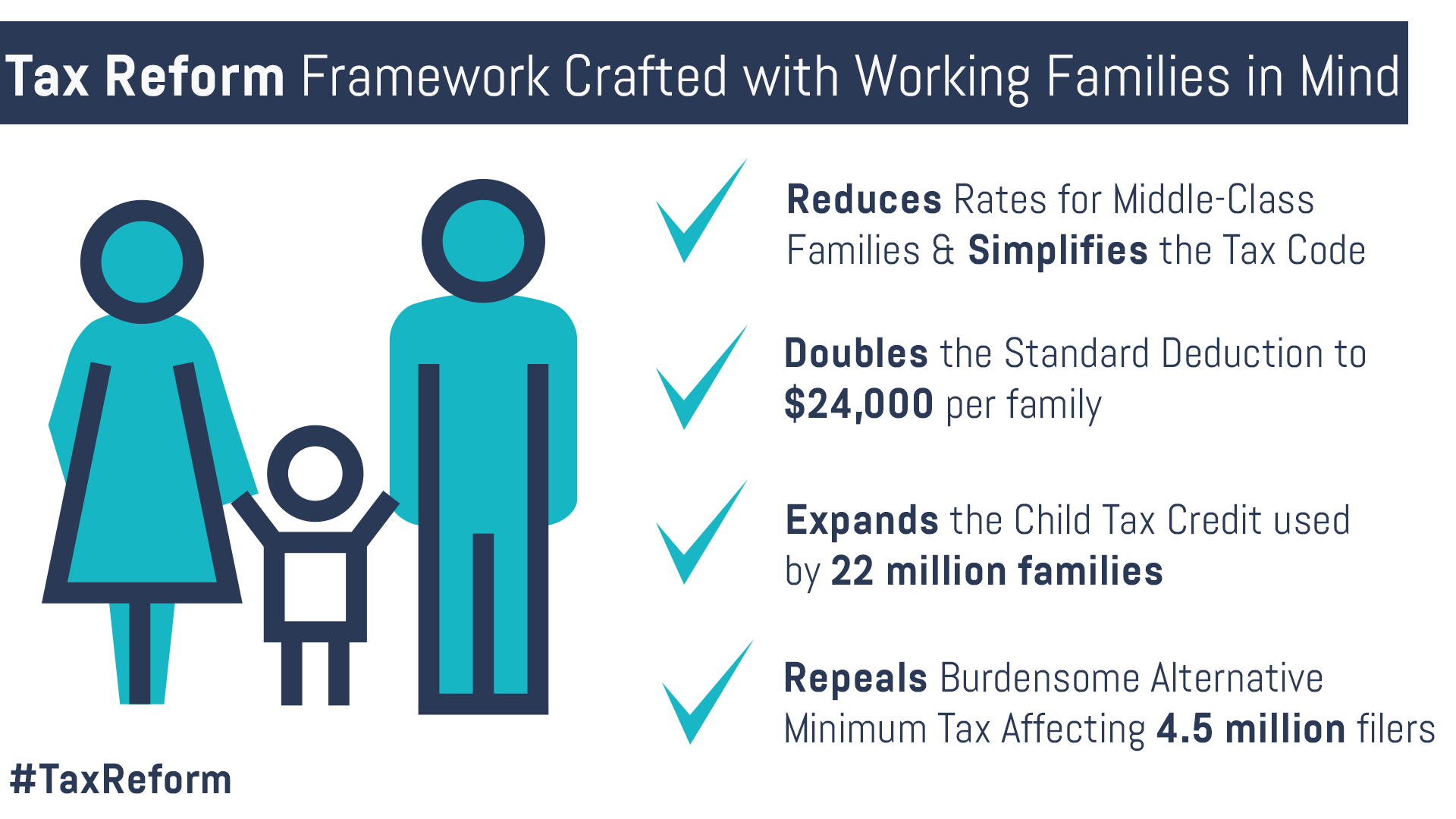

Tax Reform Framework Crafted with Working Families in Mind

Senate, House and Administration Committed to Lifting American Families, Providing Relief

In his inaugural address, President Trump said that “every decision” on taxes would “be made to benefit American workers and American families.” So, it’s no surprise that the unified tax reform framework released last month was crafted with working families in mind:

-

It simplifies the tax brackets and reduces rates for middle-class families. A recent study by economists at Boston University and MIT finds that it would increase real wages by 4 to 7 percent, translating into about $3,500 a year, on average, per working American household.

-

It doubles the standard deduction to $24,000 for a family and $12,000 for individuals – a significant tax cut for the 105 million taxpayers who chose to take the standard deduction in 2015.

-

It will expand the Child Tax Credit, which already is used by more than 22 million Americans across the country. Studies show the Child Tax Credit leads to higher child educational and health outcomes, resulting in higher life time earning potential.

-

It will repeal the burdensome Alternative Minimum Tax (AMT). An estimated 4.5 million individual filers were hit by the onerous individual AMT in 2015, accounting for more than $26 billion in federal tax payments.

-

It also includes several provisions designed to further lift middle-class families – whether boosting job growth and increasing take home pay or encouraging personal savings and investment here at home.

Next Article Previous Article