Continuing Epstein Investigation, Wyden Releases New Analysis Detailing How Top JPMorgan Chase Executives Enabled Epstein’s Sex Trafficking Operation

Democratic Staff Memorandum Cites Need for Further Investigation

Washington, D.C. – Continuing his “follow the money” investigation of Jeffrey Epstein’s sex trafficking network, Senate Finance Committee Ranking Member Ron Wyden (D-Ore.) released a detailed analysis today of the ways in which JPMorgan Chase protected Epstein and enabled his sex trafficking operation through an egregious series of compliance failures spanning nearly two decades. The analysis, contained in an 18-page Democratic staff memorandum, draws on recently unsealed court documents that included correspondence between top JPMorgan executives, as well as Senator Wyden’s own investigation of Epstein bank records. The records show top JPMC executives reporting directly to CEO Jamie Dimon closely supervised the relationship with Epstein. The memorandum also examines Epstein’s payments to Ghislaine Maxwell, who is now enjoying special privileges in a minimum-security facility, and the close involvement of accountant Harry Beller, who had signatory authority over Epstein’s accounts.

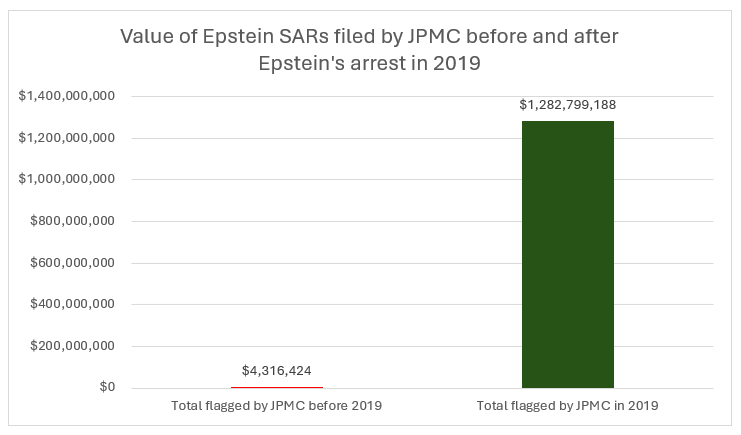

Among other findings, the memorandum states that JPMorgan severely underreported Epstein’s suspicious financial activity prior to 2019. While Epstein was alive and trafficking women and girls, the bank flagged a small number of transactions adding up to only slightly more than $4.3 million. After Epstein’s death in federal custody, the bank filed retroactive suspicious activity reports covering an amount nearly 300 times larger, almost $1.3 billion in thousands of transactions dating back to 2003.

“When you go through the evidence laid out in this memorandum, it’s clear that JPMorgan Chase ought to face criminal investigation for the way it enabled Epstein’s horrific crimes. Bank executives tuned out compliance officers who were alarmed by Epstein’s transactions, seemingly withheld evidence of potential money laundering, and coached Epstein on how to obscure suspiciously large cash withdrawals. This goes beyond a total compliance breakdown, and it’s impossible to believe the decisions that led to this disaster never reached the very top of the executive suite,” Senator Wyden said. “With more and more Epstein information coming to light, the question is what happens next. Given the scale of Epstein’s trafficking operation and all the money involved, it’s unacceptable that only he and Maxwell have faced prosecution. Complicit banks ought to be investigated, as should anybody who helped Epstein traffic his victims or took part in the abuse. It was a huge victory passing legislation this week requiring the Department of Justice to release its Epstein file, but I’m extremely concerned Trump and Bondi are faking investigations as a pretext to block any further disclosures. The Treasury Department also has its own Epstein file containing thousands of bank records, and that file is unaffected by the legislation Congress passed this week. My investigators saw a portion of that file in 2024, but Secretary Bessent has refused to produce it for further examination. That makes him a part of the Epstein coverup too. I plan to seek Senate approval of my bill to force the Treasury Department to release its Epstein file in the coming weeks because we need to continue following the money.”

The staff memorandum includes in-depth explanations of each of the following findings:

- JPMC underreported Epstein’s suspicious transactions to the U.S. government prior to Epstein’s arrest in 2019.

- Jeffrey Epstein was one of JPMC’s single largest clients and part of an elite group referred to as JPMC’s “Wall of Cash.”

- Top JPMC executive Mary Erdoes was in constant contact with Jeffrey Epstein.

- JPMC executives maintained relationships with Epstein after terminating him as a client because of Epstein’s influence over billionaire Leon Black.

- JPMC’s former CEO of Private Banking John Duffy counseled Epstein on how to execute suspicious cash withdrawals to avoid reporting requirements.

- Emails show JPMC private bankers withheld information on Epstein’s suspicious activity from JPMC’s compliance department.

- Epstein’s accountant Harry Beller was an integral part of Epstein’s financial operation and his potential links to sex trafficking crimes merits further investigation.

- Jeffrey Epstein paid Ghislaine Maxwell at least $25 million, including a one-time payment of $19 million from his accounts at JPMC.

Senator Wyden’s Epstein investigation began in 2022 with an inquiry into the sex trafficker’s financial relationship with multi-billionaire Leon Black, the co-founder of Apollo Global Management. In 2024, following a request from Finance Committee Democratic staff for access to Treasury’s Epstein files, the Biden administration allowed committee investigators to review more than a thousand pages of documents in person at the Treasury Department. Later that year Senator Wyden requested the Treasury produce the Epstein file for the committee to investigate further. (The Treasury records are not among those the administration is required to release as a result of the Epstein legislation Congress passed this week.) He made the same request early in the Trump administration, which came into office promising a greater level of transparency on Epstein matters. He also obtained Leon Black’s settlement with the government of the U.S. Virgin Islands and released new information pertaining to Black’s payment of $170 million to Epstein over several years, ostensibly for tax and estate planning services. In June, Senator Wyden again sought the Epstein files and laid out a blueprint for a proper follow-the-money investigation given the Trump administration’s refusal to act, and the following month he revealed that Epstein’s huge transactions and tax planning work may never have been investigated or audited by the IRS. In a letter to the Treasury Secretary sent earlier this month, Senator Wyden identified several individuals with documented Epstein ties and again demanded the Epstein files.

###

Next Article Previous Article